Families First Corona Virus Response

Employers have two weeks from today (until April 2, 2020) to implement this mandate. The DOL will publish employee notice samples within one week. We can also expect additional guidance on wage determination for variable hour workers and other clarifications from the Secretary of Labor.

EMERGENCY PAID SICK LEAVE

The emergency paid sick leave provision applies to employers with fewer than 500 employees. It allows a waiver for employers with fewer than 50 employees when the viability of the business would be jeopardized by paying emergency sick leave. However, the waiver process is yet to be defined.

Benefit Amount

2 weeks of employer paid emergency sick leave defined as:

• 80 hours for full time employees

• Average number of hours over 2 week period for part time employees

• When part time hours vary significantly, 2 weeks of leave determined by:

o Weekly average hours over the 6 months preceding the first use of emergency sick leave

o If employed less than 6 months, the expectation set at hire for average weekly hours

Benefit Management

The act specifies the following rules for administration of emergency paid sick leave:

• It is available immediately to all employees, regardless of length of employment.

• It is available only for purposes described in the following section.

• Employees cannot be required to use other forms of paid leave first.

• Employees cannot be required to find a replacement employee.

• Employer may require reasonable notice after the first day of paid sick leave in order to continue receiving it.

• Employers of healthcare workers and emergency responders may opt out for these employees.

• Valid through December 31, 2020 or earlier if need ceases.

• No carryover.

• No payout on separation.

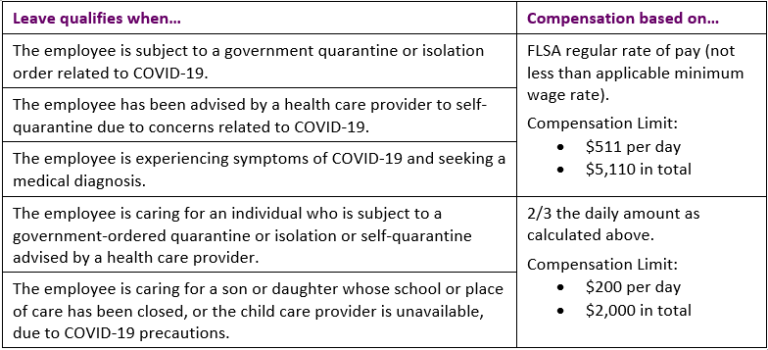

Use and Compensation

EMERGENCY FMLA EXPANSION

FMLA rules are temporarily changed to provide payment for employees who must miss work because they are caring for their own children when schools are closed or day care is unavailable due to COVID-19. This benefit expires December 31, 2020.

Eligibility

• Employer eligibility changed to any employer with fewer than 500 employees. (As with the emergency sick leave, the law establishes an as-yet undefined process for employers with fewer than 50 employees to apply for a waiver.)

• Employee eligibility changed to employed 30 calendar days.

• Employers may opt out for healthcare workers and emergency responders.

Qualifying Event

• Employees unable to work or telework due to caring for son or daughter under 18 when school or daycare is closed or child care provider is unavailable due to COVID-19.

• Applies to hours they would otherwise be working during the COVID-19 healthcare emergency.

Payment

• Leave unpaid for first 10 days.

• Employee may elect to use any accrued leave including the emergency leave during this time

• After 10 days

• Not less than two-thirds of an employee’s FLSA regular rate of pay

• Not to exceed $200 per day and $10,000 in total

ADDITIONAL RESOURCES

The following links provide more information about the Families First Corona Virus Response Act:

• Text of the Act

• Article from the American Society of Employers

• Lawflash Alert by Morgan Lewis